By: By Debra K. Rubin l Source: enr.construction.com

Built assets in 30 countries generated $27.1 trillion in global income to the world’s gross domestic product, according to a study released May 14, which says the nations studied make up 82% of global GDP.

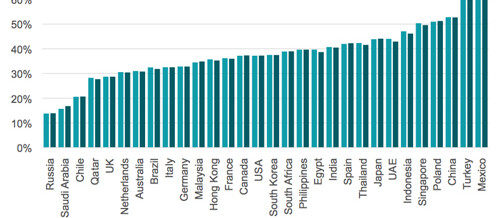

The research—which tracked income generated by buildings, infrastructure and other fixed assets—notes that the dollar total amounted to 40% of GDP, on average, in the countries studied, which are both developed and emerging economies.

The Global Built Asset Performance Index was developed by Netherlands-based consulting company ARCADIS in partnership with the Centre for Economics and Business Research (CEBR), an independent economic forecasting firm based in London.

Study authors say the research for the first time breaks down the asset contribution country-by-country. It is a follow-on analysis to the Global Built Asset Wealth Index, which ARCADIS and CEBR produced last year to quantify the value of built-asset stock.

That analysis showed the U.S. leading the world in value of its built assets, with China running a close second.

The new index shows, however, that China generated the highest returns from its built assets last year—$6.9 trillion—which is set to rise to $7.4 trillion in 2014.

Top Ten Countries by Overall Built Asset Income*

- China – $6.9 trillion

- USA – $5.5 trillion

- India – $2.0 trillion

- Japan – $1.9 trillion

- Germany – $1.0 trillion

- Mexico – $990 billion

- France – $818 billion

- UK – $693 billion

- Brazil – $633 billion

- Turkey – $622 billion

*Income shown as a ‘Purchasing Power Parity’ measure of GDP to enable accurate global comparison

But U.S.-built assets generated considerably less income on a relative basis, at $5.5 trillion, and are forecast to grow more slowly this year, just to $5.7 trillion.

The ARCADIS-CEBR analysis notes that Russia relies least on its built assets to generate income, at just 14% of GDP, which “highlights a need to invest in the quality of its infrastructure.” Mexico and Turkey generated the most economic boost, at more than 60% of GDP, due to low labor costs and large industrial sectors, researchers said.

“For the first time, our report paints a full picture highlighting the relative differences between 30 of the world’s major economies, in terms of economic returns, and assesses how differences in these economies’ effective use of their built asset stock, impact their global competitiveness,” says Manju Chandrasekhar, Americas financial institutions sector leader at ARCADIS. He is based in its U.S. unit in Highlands Ranch, Colo.

He says that “most striking, the report reveals that the U.S. is in danger of its aging built asset base leading to a slow decline in its economic power.”

The researcher emphasizes that the study “provides a layer of evidentiary support to what we have known anecdotally for some time—built assets are a significant contributor to the world economy.” He contends that a country’s failure to invest in built assets, “in a timely manner, creates risks … of a marked erosion in economic power.”

According to Chandrasekhar, the report’s analysis “can help those who own, manage and build infrastructure to more effectively plan, create, operate and redefine their built assets to optimize returns and create economic powerhouses.”

He adds “this can be very powerful information, especially for emerging economies.”

Countries included in the analysis are: Australia, Brazil, Canada, Chile, China, Egypt, France, Germany, Hong Kong, India, Indonesia, Italy, Japan, Malaysia, Mexico, Netherlands, Philippines, Poland, Qatar, Russia, Saudi Arabia, Singapore, South Africa, South Korea, Spain, Thailand, Turkey, UAE, UK and USA.

Share